Complete Guide on How to Build a Fintech App

Ethereum, Cryptocurrencies, Bitcoins – you might have heard some of these common words from people who at least have some knowledge about finance. The finance industry is advancing at an unimaginable speed with the help of technology, and given such growth, we don’t have a universal definition of FinTech. In simple words, it means the evolution of the financial sector propelled by technology to upgrade its daily process.

But building a fintech app is not a walk in the park. According to the Fintech Focus Report by Google Cloud in 2020, only 6% of finance companies break even in the market. So, you need to be on your toes with expertise both in finance and technology. If not, you might end up like Equifax, losing a whopping $4 billion due to a data breach. And this is just the security part.

With a 64% adoption rate, the fintech app development industry is expanding rapidly and is estimated to generate $123.4 billion by the end of 2025 at a CAGR of 23.84%. Undoubtedly, fintech presents huge investment opportunities, and if you’re planning to build a fintech app, there’s perhaps no better time.

But, how should the fintech app design be? What business domain should you target? What tech stack and features to include? What are the key stages you should follow to build the app? This article will be your complete guide where I’m going to answer all these questions, along with how to build a fintech app that might well become a “future unicorn.”

Here are our checkpoints to walk through today:

On This Page

- A Brief on Fintech

- The Current Market of Fintech App Development

- Fintech Trends and Forecasts

- Different Types of Fintech Apps

- Key Features to Include

- Important Technology Stack

- Essential Steps to Consider

- Cost of Building a Fintech App

- Summing Up

A Brief on Fintech

The majority of financial organizations worldwide have started to look at banking and financial operations from a different perspective. Although we can track down the very first integration of finance and technology in the late 19th century, the real game began after the global financial crisis in 2008. The age-old conception of a big banking office in a posh area became outdated as new banking channels proposed us with 24*7 digital solutions.

The growing need for innovation rapidly rolled out at every corner of the finance industry, giving rise to brand new technologies that we might have seen in sci-fi movies a few years back – online banking apps, automatic savings, pay-down services, and much more.

As per Statista, more than 65% of Americans will exclusively turn to digital banking by 2022. Techcrunch says, 90% of smartphone users opted for online payment in 2019, and 36% of them chose a payment app to do it.

Hence, even if you were not interested in investing in this industry, you may have to think again now. This is the new reality where you must start building a fintech app to keep up with your competitors.

A Significant Opportunity with Fintech App Development

Fintech is taking the finance industry by storm in more than one way. While open banking definitely accelerated this transformation, there are numerous excellent fintech applications in the market. This industry is flourishing with opportunities from online investments to saving, lending, insurance, and so on.

For example, the US is currently at the top of the global fintech market with $71.9 billion in fintech investment. Then comes the UK in the second position with $4.1 billion.

There’s another considerable trend at the heart of the fintech growth – increased usage of mobile. As mobile device penetration is continuously increasing around the globe, more and more people are using smartphones to obtain various financial services. Covid-19 acted as a catalyst here as it limited our access to the banking institutes.

Do you have a vision to develop Fintech Mobile App for your organization?

As finance gradually pairs up with mobile technology, the number of financial transactions through a mobile phone is booming too. Companies clearly noticed such trends and took steps in fintech app development. A PwC report says, at least 83% of finance firms are now investing in startups or thinking about doing so in the near future.

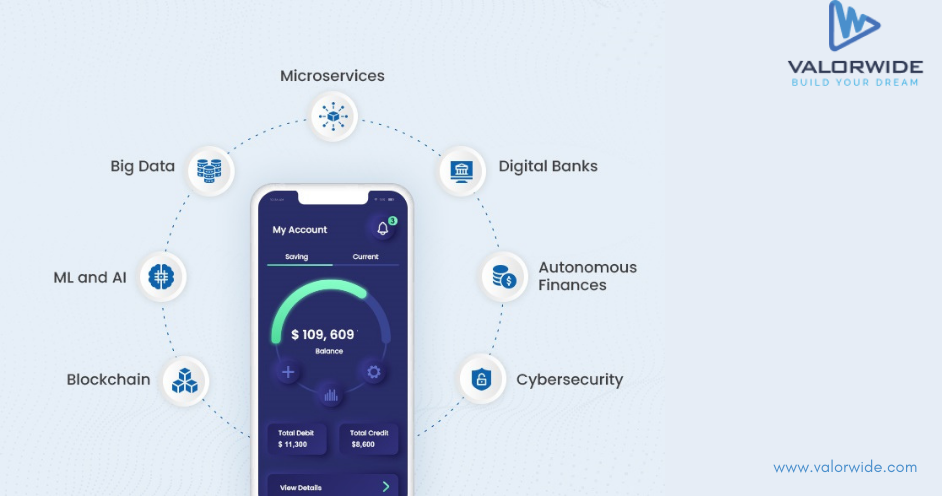

Top 7 Fintech Trends and Forecasts

The fintech industry is continuously evolving, pushing more organizations to experiment with innovative solutions. So, it’s time to check out some powerful fintech trends that might influence your perspective on fintech app development. Also, note that these trends are ubiquitous for all kinds of fintech apps.

1. Blockchain

Valorwide provides the best blockchain solution. Recently we working on a digital banking solution using blockchain. This product will serve worldwide financial services.

Blockchain – the technology is one of the fastest advancing areas in fintech. With a CAGR of over 75% and an estimated market value of $6.7 billion in 2023, blockchain is a revolutionary technology in apps with a wide array of benefits like identity and security management solutions, payments, smart contracts, settlement, etc.

Here are some core functionalities of blockchain:

- Levels up the security of sensitive financial data and apps

- Cheaper and faster transfer of money for users

- Enables users to play on the increasing demand of cryptocurrency affairs

- Seamless integration with the existing system

2. Machine Learning and Artificial Intelligence

According to Autonomous Research, by the end of 2023, AI and ML will help financial institutes cut down costs by 22%. And the reason is quite understandable – machine learning and artificial intelligence-based platforms are helping organizations analyze heavy volumes of data blocks and make effective decisions.

Additionally, you can create advanced algorithms with these technologies that will enable you to restrict unauthorized access to accounts and fraudulent activities. Needless to say, you must keep this trend in mind while building a fintech app.

3. Big Data

Did you know that devices in an organization can generate up to quintillions of data each day? Big data technology comes as a savior here. As one of the latest mobile app development trends, it will allow you to transform the raw data of customers’ behavior into essential information. So now, big data gives you the opportunity to develop the most creative marketing strategies for your fintech company.

4. Microservices

A lot of fintech apps consist of a decentralized data management system and a set of interconnected modules. Such techniques have made money lending, investment, and online payment apps easier to maintain for developers and more responsive for users.

5. Digital Banks

According to a Provident Bank study in 2020, more than 31% of the respondents use digital banking services through online apps, and only 7% of them don’t use any online banking service (most of them are over 50 years old). This clearly implies that most customers are going to prioritize digital banking services for seamless fund management and convenience transactions.

6. Autonomous Finances

Fintech app development is tremendously helpful for users to make informed decisions about where to invest their valuable money. AI-powered autonomous finance apps help customers make the best use of their money, just like the navigation app on your phone showing the most optimal route to your destination.

Although autonomous finance is still in its cradle, you must look out for this trend if your organization is thriving upon innovation.

7. Cybersecurity

Security is one of the most critical concerns for most bankers that comes as a major hindrance to future profitability. In 2020, Accenture conducted a study on the cost of cybercrime, and the result is quite frightening – a data breach can cost up to $18.3 million in an organization. Hence, we can say that you must focus on security measures above everything else while creating a fintech app design.

Top Different Types of Fintech Apps

Here’s an exclusive opportunity for you – analyzing the existing fintech apps in the market can help you learn a lot about this technology. This can help you identify the features of successful apps and incorporate useful components that your competitors might have missed.

Here I’m presenting some fintech app ideas and a few examples of the most profitable ones in every category.

1. Digital Banking

Online banking is now the go-to option for anyone who needs to manage their financial transactions and bank accounts quickly and comfortably. So now, your customers don’t have to leave their houses and be physically present in traditional banks to open an account or deposit/withdraw funds.

Whether you’re opting for bespoke Android or iOS app development services, check out these two finest examples of how to build fintech apps for digital banking purposes.

- Revolut

It’s a digital bank that lets you convert the deposited fund in your existing account into different currencies. Revolut allows customers to access the cryptocurrency exchange, transfer money internationally free, and purchase globally without a fee.

- N26

This digital-only bank provides N26 mobile apps and contactless debit cards to its customers who can manage their accounts completely online. You have to confirm your pin for every offline and online transaction and can access your account through only one mobile phone at a time.

2. Mobile Banking

Online banking and mobile banking – although these two terms sound about the same, there are many differences between them that you should know. You can make worldwide transactions with online banking, and mobile banking is software that lets you perform all your banking operations.

So, mobile banking applications let customers enjoy a myriad of services, from expense trackers to locating ATMs and quicker money transfers – everything your customers can do without the need to visit the bank. Imagine how they will love the convenience!

And as an owner, mobile banking products come up with an extensive range of business benefits like enhancing customer experience, promoting services, generating new revenue streams, and so on. Two of the best mobile banking apps are:

- Capital Banking

With a 4.5 Play Store rating, Capital One is one of the best mobile banking apps in providing customer satisfaction. It allows you to view all accounts, redeem credit card rewards, keep track of credit scores and history, and more.

- Ally Bank

As a world-class online bank, Ally Bank provides an exclusive mobile banking app for its customers. Apart from all the basic services, customers can track their investment performance, trade stocks, customize their debit cards, and so on.

3. Payment

With the improvement of payment gateways, online payment has definitely become the most popular category in fintech app development. Now, consumers and businesses worldwide seamlessly enjoy the services like currency exchange, digital money transfer, cardless transactions, mobile wallets, etc.

In this regard, peer-to-peer or P2P payment apps are particularly relevant. Not only millennials but people of all generations use these apps to receive and transfer money to each other, crowdfunding, raising collective money, and so on.

So, if you’re curious to know how a payment fintech app should be like, look at these popular examples:

- Paypal

Paypal facilitates secure transactions between customers and service providers without revealing sensitive financial details as a ruling digital payment platform. You can register your Paypal account with multiple debit and credit cards that it supports.

- Payoneer

This payment service supports cross-border and domestic money transfers. It’s very popular among freelancers as you can integrate Payoneer with plenty of freelancing platforms.

Let’s integrate a secured and feature-rich Fintech Mobile App for your business

4. Cryptocurrency

With the rise of blockchain, many financial institutes are willing to make further investments in cryptocurrency technologies. Additionally, the fact that crypto transactions are exceptionally swift, completely anonymous, and most notably, not under government rules is fueling the popularity of cryptocurrency in the fintech app development industry.

Cryptocurrency apps provide a wide range of benefits to us, from tracking the crypto market and investment opportunities to accessing your mobile wallet and much more. Mentioned below are two of the successful cryptocurrency apps in today’s market.

- Binance

With the highest trading volumes in the world of cryptocurrency apps, Binance lets you invest and trade your fund with a minimal charge. It’s also a super safe platform with an uncomplicated user interface.

- eToro

eToro is a great platform for investors and traders with proper KYC authentication and effective security measures. This app also allows you to copy the trade strategies of successful traders so that you can apply their schemes to your business.

5. Mortgage and Lending Services

Mortgage and lending apps are the best examples of how building fintech apps has made the overall finance business more efficient and transparent. As modern customers, we find the conventional mortgage and money lending process very tedious and complicated without any need.

But thanks to fintech, the latest mortgage and lending apps can automate the whole time-consuming and laborious tasks. You can also regularly check with the credit bureaus through the apps, facilitating the whole process for you. So, keep these two apps in mind while choosing the finest Android app development solutions or iOS.

- Better

The Better app has gained a 5-star rating from Forbes for providing comfort and convenience in more than one way. With a commission-free business approach, it offers fast pre-approval time (around 20 mins) and automatic discounts.

- Wells Fargo

This is a convenient lending platform that provides a well-organized application process and efficient layout. You can seamlessly manage home loans, check deposits, check credit history, and more.

6. Investment

Stock trading and investment management platforms will enable your customers to analyze different financial assets and invest for the best profitability. The stock market is a complicated domain, and investment services apps bring a great opportunity to those who want to set about in this domain.

So now, customers can improve their investment performance by getting investment recommendations and accessing important data and analytics. If you’re interested in building a fintech app with investment solutions, have a look at the following apps for some ideas:

- Addepar

With various asset types in any currency, Addepar deals with the global financial system to offer investment management solutions to investors and advisors. Hence, such insights will help your customers make better investment plans.

- E-Trade

It’s one of the best wealth management services for users. E-Trade provides efficient suggestions for online trading and recommends where, when, and how to make investments.

7. Regtech

Regtech deals with advanced, innovative technologies to resolve regulatory policies. Software solutions of this kind empower organizations to assess regional policies and analyze the current process to ensure complete compliance with the requirements.

So, regtech apps facilitate the monitoring process by eliminating possible human errors. Following are the best regtech apps in the present industry:

- PassFort

With automated AML, KYB, KYC, and more compliance checks, PassFort is a regtech compliance platform that allows you to translate compliance schemes and policies into automated, digitized onboarding tasks.

- 6clicks

It’s a global compliance and risk assessment software. 6clicks covers the risk management lifecycle and offers automated risk detection, assessment, and reviews for each stakeholder.

8. Insurance

Digital insurance services or insurtech companies use modern technologies to engage more customers. From speeding up the commission process to reducing fraudulent activities, insurtech apps offer a myriad of time-effective solutions.

Check out the below apps for excellent fintech app design ideas in the insurance sector:

- Trov

Trov is one of the popular insurance apps in the market right now. Customers can insure single property assets for any period of time, store crucial information about their property, and upload it on the cloud as well.

- BIMA

BIMA collaborates with financial businesses and network operators to provide insurance through smartphones to millions of people. This popular insurance app offers health microinsurance, personal accident, lifetime insurance, and so on.

9. Budgeting and Personal Finance

Financial planning and budgeting apps help customers have better control over their finances. By forecasting investments and analyzing expenses, this type of fintech app has gained much love among general users.

Besides, these apps will enable your customers to manage, track, and budget their funds without the need to change interfaces. Here are two sophisticated budgeting apps you should consider looking at:

- Mint

A free budgeting portal that helps customers keep track of their income and expenses. You can register the Mint app with different credit cards, bank accounts, and Paypal.

- MoneyPatrol

This service allows you to monitor your bank accounts securely. MoneyPatrol provides auto-bucketing categories that help you track all of your spending seamlessly.

Key Features You Must Include While Building a Fintech App

Hear me out – if you want your fintech app to successfully stand out among competitors, you must be very careful with the value proposition of your app to push it at the front line of the industry. Work on brainstorming ideas to identify and solve users’ problems.

And in order to do so, you don’t need to come up with something brand new, but you can always try to develop a more powerful mobile app than the existing ones.

I have done my part by researching the most crucial feathers of a fintech app that you must consider for success:

- Build a simple and intuitive interface. What most consumers expect from a fintech app is a user-friendly and compelling application interface. Moreover, a captivating user interface will help your app outmatch your competitors.

- Ensure a smooth payment gateway. Your fintech app design should efficiently run the basic tasks like checking account balance, various digital payments and transferring money. However, you should compromise the security of your app in order to provide a convenient payment gateway.

- It’ll be a great achievement if you can include multi-user support with an effective user management system in your app. Finance management apps are in huge demand from multiple family members and several employees of an organization for sharing and monitoring a single account.

- Customers will surely love your app if you provide them with a personalized app experience. Build a fintech app around the requirements of your users so that they can use it conveniently. For example, let your users filter the information they want to receive, like new updates, push notifications, etc.

- Security, as we all know, is tremendously important for a fintech app. While user data definitely provides a more personalized and richer experience, you must integrate the highest security level to protect your users’ sensitive information. Simply, the authentication process should be both intuitive and highly secure.

- Online chats can most certainly improve your customer satisfaction rate. For most customers, online assistance is a more suitable alternative to email and phone support. Moreover, AI-powered chatbots help in reducing costs and enhancing the user experience by assisting clients and answering their questions 24*7.

- With the dashboard and reporting feature, your user can access their data and have better control over finance in a single interface (trading charts, money movement, transaction history, etc.). Accordingly, your developers must maintain the accuracy and speed of this data. You can also allow your users to go through particular aspects if they want to explore and learn.

So, there you go with all the must-have approaches to include in your fintech app design. Now let me mention some special features that can set your product apart from others.

- Integration with QR scanners, barcodes, and social network services.

- Independent app functionality with no or poor cellular data.

- Push notifications about every important activity.

- Geolocation to discover nearby bank institutes, cash registers, ATMs, etc.

- Analytics to prepare brief reports on account activities.

- Currency settlements or conversions with the help of cryptocurrencies.

- Two-factor verification and biometric authentication (face or touch ID).

Important Technology Stack for Fintech App Development

Once you have determined the functionalities and design of your fintech app, it’s time to choose the right tech stack for the front-end and back-end development. You would need:

- Cross-platform mobile app development with frameworks like React Native and Flutter or other advanced frameworks like Django and Node.js for app development.

- Software Development tools, environment, and kits such as Android and iOS SDKs, Android Studio and Developer Tools, Apple XCode, etc.

- Programming languages like Kotlin and Java for Android or Swift and Objective-C for iOS, C#, C++, Python, JavaScript, etc.

- Cloud computing platforms like Mobile Backend as a Service (MBaaS) and Platform as a Service (PaaS) to manage the OS, infrastructure, or network.

- Databases such as MongoDB, PostgreSQL, MySQL, etc.

- Third-party APIs like Yodlee, Stripe, Experian, Slack, etc.

In addition to these technologies, tools like Postman are useful for developing and testing APIs and Swagger to document them. You would also need an HTTPS SSL certificate to build orders for API requests and protect the user data by deploying TLS (transport layer security) for every network.

8 Essential Steps in Successful Fintech App Development

Now that you have reached this point of the article, you must be wondering about how to start developing a fintech app and what mobile app development stages you should follow. Let me explain in detail.

Suppose you’re planning to develop a rental management app. Your users will be able to check the credit scores of potential tenants, build and digitally sign a contract, accept security deposits, manage their release when the leasing contract ends, easily renew contacts, and so on.

In such a project, your value proposition is to increase the ROI for property owners and streamline the application process for tenants – a kind of win-win scenario every fintech app should aim for.

So, you need to develop multiple functionalities for this app, and if you follow the hard way, your developers need to hard-code all these functionalities one by one. The whole process would take a long time and a good amount of fortune. But thankfully, you have APIs for each of these functionalities that make the fintech app design process much easier.

Step 1: Manage and Authenticate Users

Your weapon to manage and authenticate users is Firebase. Look upon this tool as the skeleton of your app on which you have to place the organs and muscle-like functionalities. Additionally, Firebase offers crash reporting, user management, and authentication. You can integrate a host of Google services with it to provide a great app experience to your users.

Step 2: Implement Secure Hosting

The engine room of your fintech app would be Cloud Firestore. It’s a Firebase product that works as an encrypted solution of a cloud-hosted database. You can integrate with other Firebase products for a rich user experience and efficient app development. Besides, Cloud Firestore simplifies development, enables optimized performance, and has automated scaling.

Step 3: Incorporate Credit Score Checking

Universal Credit Services offers Credit Report API that obtains data from 3 credit bureaus (Experian, Equifax, and TransUnion) and generates single-unified credit reports for users. Your app can also support bulk requests with the help of this API.

The UCS API enables customers to access the following data:

- SSA-89

- Decision-only credit reports

- 4506-T IRS TAX Transcripts

- Credit records before employment

- Social Security Number authentication

- Eviction searches

- Criminal searches

- Motor vehicle reports

Apart from this, you can use a consumer-facing API from Experian for generating credit reports and scores. Your customers can also share their reports with third parties online. And lastly, the American Credit Systems (ACS) allows you to create full public records, FICO scores, credit reports, and generate credit inquiries.

Step 4: Link Bank Accounts

Plaid is a very popular and effective API in the fintech app development industry, helping link your bank account to the app. This API carries out a wide array of tasks that would be very difficult for you to complete otherwise. Plaid speeds up the development process, reduces risks, and aggregates the financial data of your users on a single platform.

Yodlee is another financial data consolidating API that helps to access bank accounts efficiently.

Step 5: Integrate Payment Gateway

For setting up a secure and smooth payment gateway, I would strongly recommend Stripe. As a global payment processor, it merges several payment service vendors into one single solution so that your customers don’t need to save their credit card details and abide by the PCI certification. You can also integrate Stripe with Plaid.

Step 6: Establish Chat Support

Chatbot provides an amazing API that can effectively automate your customer support system. As this API is powered by machine learning and Natural Language Processing, it can facilitate a wide array of complex operations, such as the pre-approval process for applicants. It uses open-source libraries like scikit-learn.

Step 7: Add Plug-Ins

If you’re thinking about adding financial management to the dashboard of property owners, go for the Intuit API. It consists of a set of tools that reflects the financial health of an enterprise. This API owns Mint and QuickBooks.

If you want to implement a data visualization feature in your fintech app, D3.js is the best framework for you. This JavaScript library uses CSS, SVG, and HTML to manipulate data and create visualizations. So, if your app needs to build a visual representation of your user’s financial data or just enterprise budgeting and resource planning, D3.js is the perfect API for you.

Step 8: Consider Legal Requirements

While building fintech apps, keep in mind that you are going to handle very sensible data of the users. At your own expense, hackers would absolutely love to get their hands on this data. Hence, allow me to discuss a few more actions you must implement in your fintech app:

- Carefully go through legal obligations related to accessing the financial data of your users with these APIs

- Implement an insurance policy to cover you if a data breach occurs

- Develop data management and privacy regulations

- Create a business continuity and disaster recovery plan in action

Providing a fintech service does not sum up your responsibility. You need to go all the way and take extra steps to gain users’ trust and reliability as they will invest their life savings in your initiatives.

Cost of Building a Fintech App

The cost to develop a successful app completely depends on a number of factors such as size, features, integration, complexity, development time, etc. The hourly rate of building a fintech app varies from one region to another. Here I have mentioned the approx hourly rate in various regions looks as follows:

Region Cost/Hour

USA ——————– $100-$120

UK ——————— $90-$100

Australian ————– $70-$90

Western Europe——– $70-$90

Eastern Europe ——– $60-$70

India ——————- $40-$50

South America ——— $50-$70

Bangladesh ———- $28 -$40

Bangladeshi Software companies provide high-quality software at affordable prices

Want to know how much will it cost to develop a Fintech Application?

Summing Up

If you have planned to start a fintech venture, all the opportunities are there for you to establish a profitable and successful business. Certainly, you’ll face a series of hurdles on your way to victory but isn’t that the case with every tech initiative?

The truth is, you can easily combat all such challenges with the top fintech software development company on your side. At Radixweb, we have highly experienced fintech developers for fintech software development that can help you create the finest fintech solution in the market. It’s time to stop waiting around and start building your dream app together!

Addressing Critical Software Development Challenges in the Financial Industry -

July 21, 2023[…] software development or FinTech app development has revolutionized the way banking and financial institutions operate. It offers a multitude of […]