Addressing Critical Software Development Challenges in the Financial Industry

In the fast-paced world of finance, where billions of dollars change hands within milliseconds, the importance of reliable and efficient financial software systems cannot be overstated.

The financial industry heavily relies on custom software solutions to power its operations, ranging from high-frequency trading platforms to robust banking systems. However, despite the remarkable advancements in technology, financial software development services come with its own set of challenges.

From regulatory compliance to cybersecurity concerns, these challenges not only shape the way software for financial sectors is built but also impact the stability and trustworthiness of the entire financial ecosystem. And this is exactly why nearly 100% of the FinTech enterprises had some security or privacy issues associated with web apps, APIs, and subdomains.

Let Us Simplify Your Financial Operations and Empower Your Team with Intuitive Software Solutions

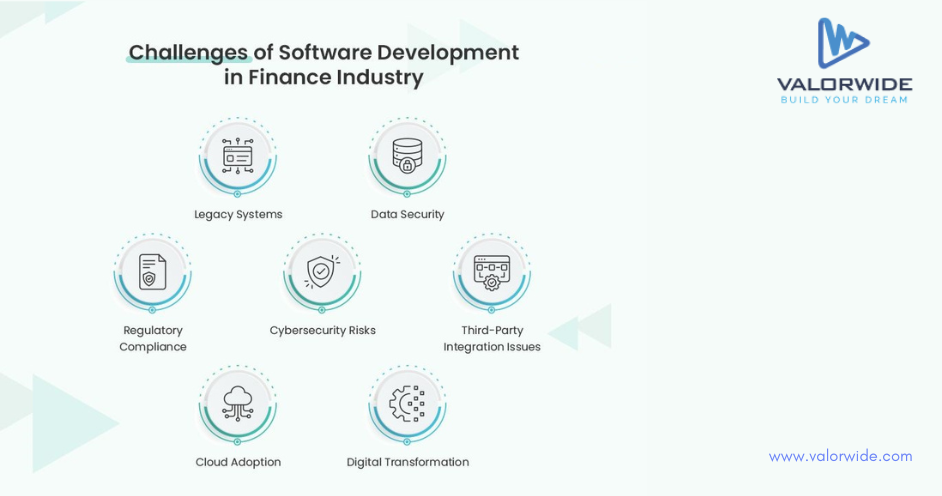

In this blog post, we will discuss the top seven software development challenges that the financial industry is currently facing.

On This Page

- What is Financial Software Development?

- Convergence of Software Development and Finance Industry

- Top Software Development Challenges in the Finance Industry

- Summing Up

What is Financial Software Development?

Financial software development or FinTech app development has revolutionized the way banking and financial institutions operate. It offers a multitude of advantages that not only propel them towards compliance and competitiveness but also empower them to meet evolving customer demands with precision and confidence.

But as you may already know, security is of utmost importance in the financial industry, and thankfully, financial software systems serve as an impregnable fortress against malicious attacks. By employing comprehensive security protocols and staying ahead of regulatory requirements, organizations can safeguard sensitive customer data while adhering to the highest industry standards.

This, in turn, helps to foster trust, ensures compliance, and shields financial institutions from the devastating consequences of data breaches.

Furthermore, innovation also plays a crucial role in the advancement of the finance industry, and custom software development can help breathe new life into banks, empowering them to keep pace with the latest fintech trends.

With tailored software for banks, developers can unleash their creativity and develop cutting-edge services and features that capture the imagination of the bank’s customers. This not only keeps them competitive in the market but also cements their position as pioneers in revolutionizing the way people interact with their finances.

All in all, the convergence of custom software development and the finance industry empowers organizations toward a future of enhanced security, innovation, scalability, and interconnectedness. It equips financial institutions with modern financial management software needed to comply with regulations, stay ahead of the technological curve, and meet the diverse needs of their customers.

Convergence of Software Development and Finance Industry

The convergence of software development and the finance industry has brought forth a remarkable transformation in the way we manage and interact with our financial resources.

As technology continues to advance at an unprecedented pace, software developers and financial institutions are joining forces to redefine traditional banking, investment, and transactional processes. This powerful alliance has opened doors to innovative FinTech app development solutions, streamlined operations, and enhanced user experiences.

One of the key drivers of this convergence is the rising demand for seamless and personalized digital experiences. Consumers expect intuitive interfaces, real-time updates, and effortless transactions at their fingertips.

Efficiency and Profitability Go Hand in Hand, and Our State-of-the-Art FinTech Software is the Key to Unlocking Both

Finance business software developers are rising to the challenge, leveraging cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), and blockchain to create robust and user-friendly applications that cater to these evolving expectations.

Moreover, the integration of software development in the finance industry has significantly improved accessibility and financial inclusion.

While the convergence of software development and finance brings forth exciting opportunities, it also poses unique challenges. And this is precisely what we’re about to talk about next.

Top Software Development Challenges in the Finance Industry

Let’s talk about the seven software development challenges that are currently the most important in the finance industry to overcome:

1. Legacy Systems

The finance industry has a rich history, with many institutions relying on legacy systems built on outdated technologies. These systems often pose a significant challenge when it comes to financial software engineering.

The task at hand is not only to modernize and update these systems but also to ensure seamless integration with newer technologies. Overcoming the complexities of legacy systems demands a delicate balance between preserving functionality and embracing innovation.

Specifically, the challenge currently lies in charting a path to modernization that minimizes disruption, maximizes efficiency, and unlocks the potential for future growth.

2. Data Security

In an era where data breaches make headlines every day, data security stands as a top concern in the finance industry.

As you may already know, financial institutions handle vast amounts of sensitive information, including personal and financial data. The challenge for developers is to create the best financial software product that protects data throughout its lifecycle.

Encryption, access controls, and secure storage are just the tip of the iceberg. Developers must stay on top of the latest security best practices and evolving threats to proactively mitigate risks and ensure the integrity and confidentiality of sensitive financial data.

3. Regulatory Compliance

The finance industry is heavily regulated, with a myriad of rules and compliance requirements imposed by government bodies and industry watchdogs.

This is the reason why finance business software developers in finance face the daunting challenge of incorporating these regulations into their systems at present. From Anti-Money Laundering (AML) to Know Your Customer (KYC) requirements, adherence to regulations is non-negotiable.

Therefore, developers must figure out a way to navigate the complex web of rules, implement robust compliance measures, and ensure seamless integration of compliance frameworks into software solutions.

4. Cybersecurity Risks

As financial institutions embrace digital transformation, the threat landscape expands exponentially. Today, cybercriminals employ sophisticated tactics to breach systems, steal data, and disrupt operations. That’s why it is critical for developers specializing in software for financial use to always stay one step ahead in mitigating the rising cybersecurity threats in the financial industry.

Some of the ways to manage and mitigate these risks are by implementing multi-layered security measures, conducting regular vulnerability assessments, and ensuring timely patch management.

However, embracing these security practices is not enough. To win the battle against cyber threats, you must develop a proactive mindset, conduct continuous monitoring, and utilize a comprehensive approach to cybersecurity that permeates every aspect of fintech software development.

You need a unique Fintech app to stand out from the rest. Let’s collab to make something innovative and sustainable

Create Something Extraordinary

5. Third-Party Integration Issues

In a highly interconnected financial ecosystem, third-party integrations are vital for seamless operations. However, integrating diverse systems from different vendors can be a Herculean task. Developers must come up with innovative FinTech app ideas for startups, overcome compatibility issues, align data formats, and establish secure communication channels.

In other words, fintech product development experts must ensure that all components work harmoniously, maintaining data integrity and system reliability. This can be done by implementing robust testing measures, comprehensive API documentation, and effective communication with third-party vendors.

By doing so, you can overcome the integration hurdles and create a unified environment that powers the finance industry’s complex operations.

6. Cloud Adoption

Cloud adoption has become a driving force in the finance industry. Moving to the cloud offers numerous benefits, including scalability, cost efficiency, and enhanced collaboration.

However, this transition presents unique challenges for fintech. Migrating complex financial systems before building a fintech app requires careful planning, architectural redesign, and data migration strategies.

To put it simply, ensuring data security, compliance with regulations, and maintaining seamless integration with existing systems are difficult hurdles to overcome. But, by harnessing the full potential of the cloud, you can certainly get past these challenges with innovative and agile software for banks and financial institutions.

7. Digital Transformation

Digital transformation is reshaping the finance industry, and software developers play a pivotal role in this transformation.

However, the path to digital transformation has its own set of unique challenges. That’s why, developers must strike a balance between legacy systems and emerging Fintech technology stacks, seamlessly integrating new digital services while preserving the functionality and security of the existing infrastructure.

Right now, the main challenge of digital transformation in the finance sector is creating user-centric experiences, optimizing workflows, and leveraging technologies such as artificial intelligence, machine learning, and blockchain to unlock the full potential of digital transformation. With the right technology, resources, and expertise, it is possible to overcome this hurdle.

Your Vision, Our Expertise. Together, We Can Reshape the Future of Your Enterprise with Avant-Garde Custom Software Solutions

Summing UpThe financial industry is in the midst of a technological revolution, powered by financial software solutions. As financial institutions strive to stay competitive, deliver seamless user experiences, and navigate regulatory landscapes, they face a myriad of software development challenges, which we just discussed. But as you have learned, these challenges aren’t insurmountable. With determination, expertise, and a commitment to innovation, you can definitely break down these barriers and build secure and user-centric solutions successfully. Valorwide, a pioneering financial software development company, possesses the prowess to tackle the intricate challenges of the fintech industry. We have a team of seasoned software engineers who have the ability to decipher complex financial requirements and translate them into robust software solutions. Moreover, we’re well-versed in the art of crafting scalable and secure software applications. In an industry where data privacy and security are paramount, our developers employ cutting-edge technologies and follow industry best practices to fortify the integrity of financial systems. In conclusion, our adept team, unwavering commitment to security, agile approach, and collaborative ethos will empower your financial organization to overcome obstacles and thrive in the fast-paced digital realm. Reach out to us now!

FAQs

What are the technical challenges faced by the financial industry?

The financial industry faces several technical challenges including cybersecurity, data management, regulatory compliance, legacy system modernization, scalability and performance, and customer experience.

What impact technology has on the finance industry?

The development of technology has had a profound impact on the finance industry, transforming the way financial services are delivered, consumed, and managed. Additionally, it has accelerated digital transformation, improved customer experience, enhanced efficiency, and automation, and enabled global connectivity as well as cross-border transactions.

What is the biggest challenge to the fintech industry?

One of the biggest challenges to the fintech industry is regulatory compliance and navigating the complex regulatory landscape. While fintech companies strive to innovate and disrupt traditional financial services, they must also comply with various regulations imposed by government authorities.

qGhZiDoRXsn

February 28, 2024NUcLxsJP

iKEhPfVjTd

March 23, 2024ecurQVCU

VIPaMbxsgwlCJ

May 15, 2024rMOxUwmEiZqtkW

yqjRNMtDQS

May 22, 2024sRBTyYCuVAfN

YnBOogZMAClELu

June 7, 2024IpboVETWFgAP

DOYhdmWvuwEqZR

June 27, 2024CquGvVwMgl

EGabBQrltJc

August 7, 2024wZCJNtqeOjbsThap